Add PrePayments (Advances)

Owners that have advanced funds for prepay of expenses, may be entered here.

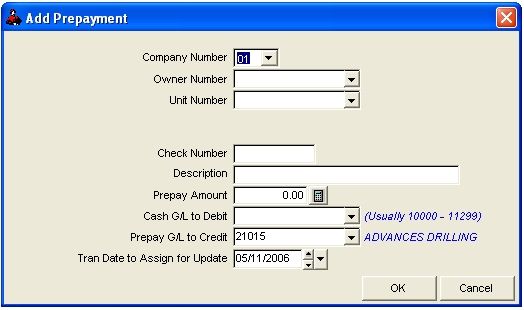

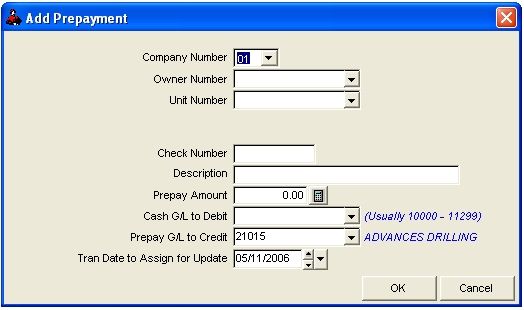

Select JIB - Tools for Statements - Add PrePayment

The Division of Interest file will be updated for the prepay balance. The general ledger Transaction file will be updated with a debit to your cash account and a credit to the prepay account usually 21015 or 21020 for the prepay balance.

If specific GL numbers are to be used for prepay funds such as 71xxx but not 74xxx, you need to assign two separate units. An example would be unit 30001-01 Labay Drilling & Completion well. This unit would have prepaid balances and only general ledger numbers for drilling and completion should be charged against this unit. Prepay balances would be reduced against expenses 71xxx charged to this unit. A debit to the prepay account, usually 21015 or 21020 would be generated and a credit to JIB Offset, usually 76320 would be made when you update for Operating Statements.

Unit 30002-01 would be Labay Operating well. This unit would not have any prepay balances and Investors would receive an Accounts Receivable invoice for expenses 74xxx charged to this unit. A debit to Accounts Receivable, 11300 would be made for their share of expenses to this unit and a credit to JIB offset, 76320 would be made for this unit when you update for Operating Statements. Update for Operating Statements will ask you to debit against a liability account for prepay used, usually 21015 or 21020. If no prepay balance is available, 11300 Accounts Receivable will be debited automatically and an Accounts Receivable invoice would be generated. The credit would be made to JIB offset account, 76320.

FILES THAT ARE UPDATED

DOI.DBF - Prepay balances are updated for each owner on each unit.

TRAN.DBF - Debits & credits are added reflecting a debit to the cash general ledger and a credit to the prepayment general ledger number.

BANK.DBF - The Bank will be updated for deposits to your cash.

TO VERIFY ACCOUNTING ACCURACY OF PREPAYMENTS

Print the Prepayment (Advances) report from the JIB module on your tool bar under Other Reports and compare the ending balance for the company to the Trial Balance for the prepay general ledger number you entered for prepayment. The totals should always agree.

When Operating Statements are printed and updated, Investors are not billed for expenses when they have a prepayment balance remaining in the Division of Interest file. Instead, the prepayment balance is adjusted in the Division of Interest file, and the general ledger prepayment account is debited and JIB Offset account is credited.

TRANSFER PREPAYMENT

This option will allow you to transfer prepay for an owner from one Unit to another Unit. You will be able to transfer 100% of the current prepay on a unit or just a desired amount. You will be asked for a ‘Transaction Date to Assign for Update’ and the ‘Prepay G/L’ number (this should be the original G/L number used when the Prepay was added).

Related Topics

How to Apply a PrePayment to Accounts Receivable Invoices

How to Refund a PrePayment (Advance)

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.